-

走进福信

- 新闻中心

新闻中心福信钢铁是热轧H型钢经销加工配送大型物流企业,是马钢H型钢山东地区代理商,是莱钢H型钢经销商,是日钢经销商,是鞍山宝得钢厂经销商,福信人经过二十年的艰苦奋斗和辛勤耕耘 ,用户遍布石化、化工、炼油、钢铁、船舶制造等领域。

- 产品展示

- 人力资源

- 在线留言

在线留言- 联系我们

- Home

Home- About Us

About UsFuxin Iron and Steel Co., Ltd. was established in 1993. The head office is located in the scenic coastal city of Yantai Development Zone.

- News

NewsAfter 20 years of hard work and hard work, Fuxin Steel has customers in petrochemical, chemical, oil refining, steel, shipbuilding and other fields.

- Products

ProductsThe company has become a qualified supplier in the e-commerce network of Sinopec and PetroChina, a quality credit AAA enterprise, and has passed the quality management system certification required by the ISO9000 standard.

- Jobs

- Messages

Messages- Contact us

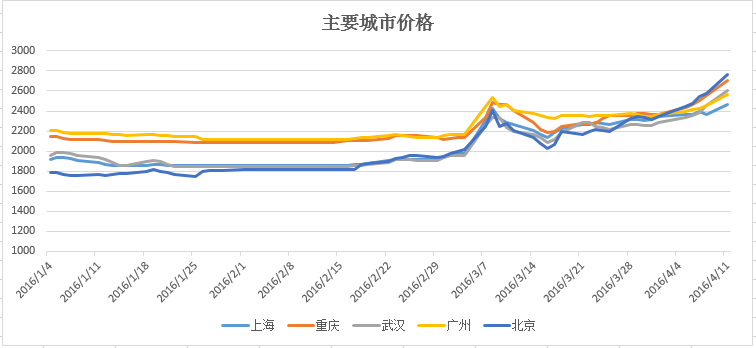

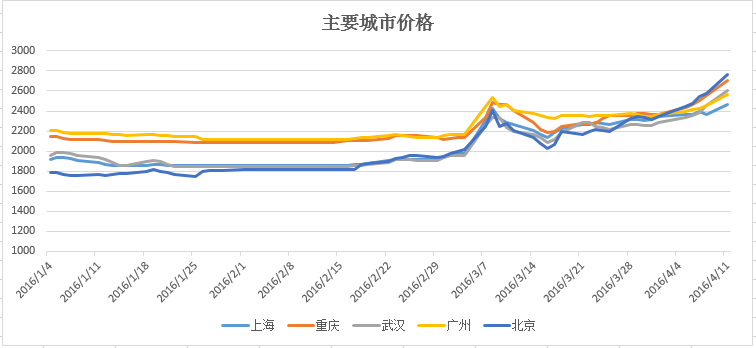

Contact usAfter the east side is bright, the west side is bright, the national building materials may be approaching 3000Release time:2016-04-12 22:20|Reading volume:Today, domestic construction steel prices have soared across the board. Specifically, the average price of rebar in 25 major cities across the country was 2687 yuan/ton, an increase of 120 yuan/ton from the previous trading day, and no city was flat or fell. In terms of today's performance, with the exception of Shenyang, Harbin and other northeastern regions, where the increase was relatively small, the rest of the region rose sharply, such as Beijing, Taiyuan, Lanzhou, Jinan and other places where the increase was between 80-200 yuan/ton. At present, with the continuous increase in billet prices and the sharp rise of black futures, domestic spot prices have skyrocketed. However, market resources are scarce and steel mills have insufficient inventory, which makes businesses more bullish and reluctant to sell. Therefore, it is expected that domestic construction in the future Steel prices will continue to rise.

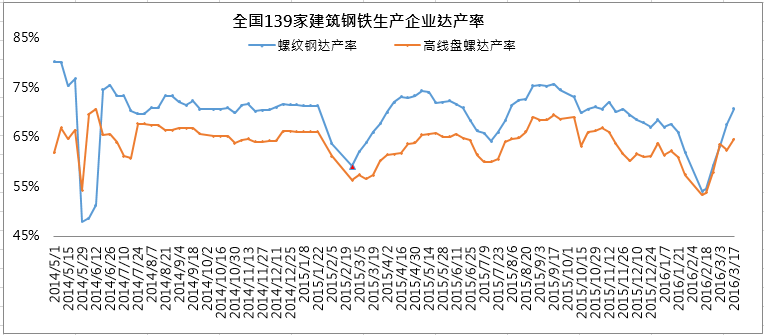

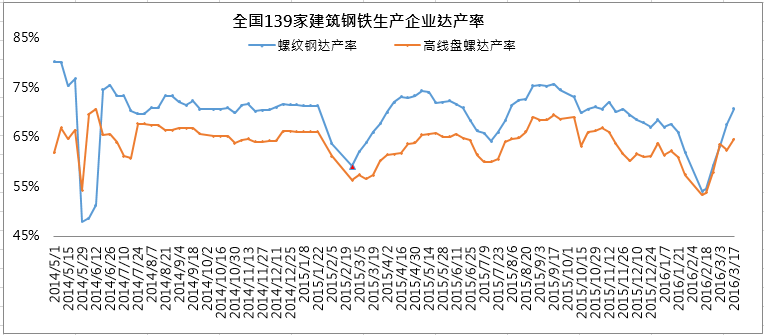

1. The steel mill resumed production cautiously, and the production rate remained low

This week, the rebar and wire rod production rate of 139 construction steel production enterprises across the country unexpectedly dropped. Data shows that the rebar production rate on April 7 was 70.5%, a decrease of 0.2% from last week and a year-on-year decrease of 1.6% , 0.3 percentage points higher than the 2015 average; wire rods were 63.1%, a decrease of 1.4 percentage points from last week, an increase of 1.6 percentage points year-on-year, and 0.6 percentage points lower than the 2015 average

In the 139 building materials steel mills surveyed by Mysteel this week, their weekly rebar capacity was 4.5617 million tons, the number of production lines was 305, and the actual number of constructions was 227. The weekly operating rate was 74.4%, a decrease of 1.0% from last week; The actual weekly output was 3.2159 million tons, and the weekly production rate was 70.5%, a decrease of 0.2% from last week. Among them, the East China region has the largest decline in production rate, which is 1.6%. The main reason is that the output of Shagang, Zhanggang, Sande, Sanbao, Fujian Sanshan and other steel plants have decreased.

In terms of wire rods, the weekly production capacity of wire rods was 2,244,200 tons, the number of production lines was 169, and the actual number of lines started was 127. The weekly operating rate was 75.1%, a decrease of 2.4 percentage points from last week; the actual weekly output was 1.4162 million tons, and the weekly production rate was reached. 63.1%, a decrease of 1.4 percentage points from last week. Among them, the East China region has the largest decline in the production rate, which is 4.4%. The main reason is that the output of steel plants such as Yonggang, Pinggang, Maanshan Iron and Steel, Zhanggang, Japan Steel, Sande, and Fuzhou Wuhang has decreased.

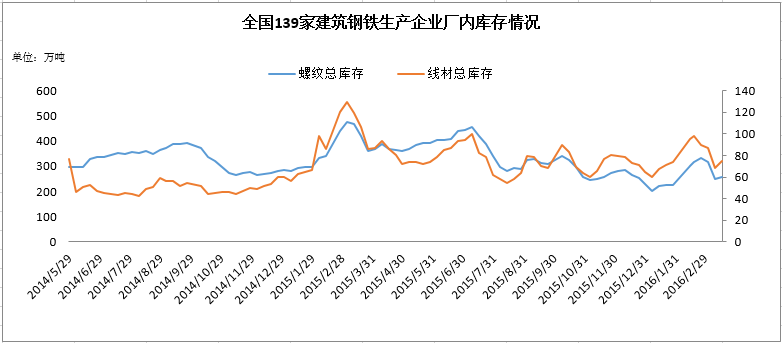

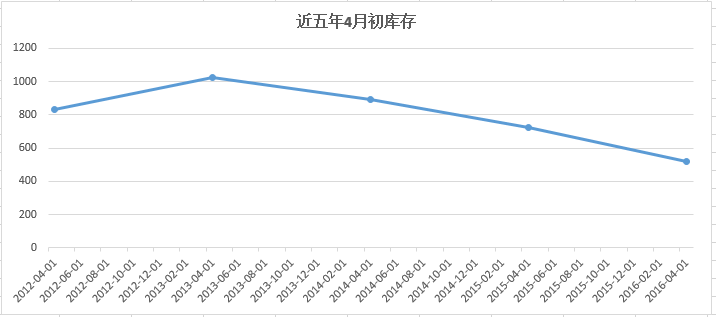

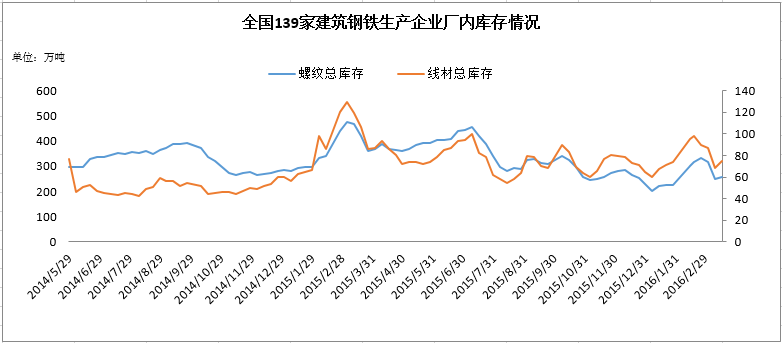

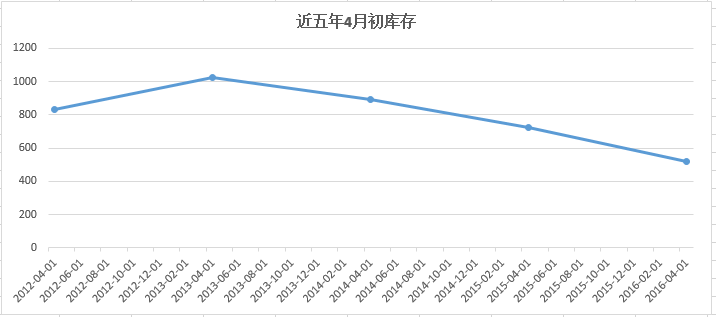

2. The social inventory of the factory and warehouse is at a low level, and the resources available for later are insufficient

As of April 7, 2016, the total rebar inventory of 139 construction steel production enterprises nationwide was 2,351,300 tons, a decrease of 98,900 tons compared with last week, a drop of 4.04%, a year-on-year decrease of 39.28%; the total amount of wire rod was 595,000 tons, This was a decrease of 45,100 tons from last week, a decrease of 7.05%, and a year-on-year decrease of 36.06%. In the later period, the delivery resources of steel mills are still insufficient.

The current rebar inventory in major cities across the country is 5,195,500 tons. Compared with last week (2016-4-1), this week’s national rebar inventory fell by 321,900 tons, a decrease of 5.83%; compared with the same period last year (2015-4-10) ) Compared with that, a decrease of 2.0163 million tons, a year-on-year decrease of 27.96%.

3. The reform from business tax to increase business value has suppressed some demand and is expected to be released in a concentrated manner after May

After May 1, 2016, the construction industry will fully implement the business tax reform and levy value-added tax. The "VAT reform" can be said to be the top priority of the construction industry in 2016. Since the implementation of the policy will significantly increase the cost of construction companies, in actual operation, there may be that the construction companies and the owners and suppliers have not considered the "VAT reform" after signing the contract. If implemented in accordance with the previous contract, the company may suffer serious losses. To effectively avoid the impact of the "VAT reform" on construction companies, some companies may delay the start-up demand and the government's reasonable solution. Therefore, the current demand may be suppressed and will be concentrated in the market after the implementation of the policy in May.

Fourth, cities are rising alternately, with strong momentum

Driven by steel billets, prices in the Beijing-Tianjin region have served as the vane of the current round of price increases. The rate and magnitude of the increase have been leading the country. However, as prices continue to rise, localities have gradually differentiated. First of all, prices in Jiangsu, Zhejiang and Shanghai have gradually evolved from low-priced areas to relatively high levels. Chongqing in the southwest and Guangzhou in southern China have become low-priced areas, while prices in the northeast are in low-priced areas in the country due to slow resumption of work. Therefore, driven by steel mills, at the end of March and early this month, prices in the Southwest and Central South regions have risen rapidly, and prices are basically the same as those in Jiangsu, Zhejiang and Shanghai. Not long ago, Guangdong Iron and Steel, Xiangtan Iron and Steel, Shaoshan Iron and Steel, Wangang, and Guixin held discussions in Guangzhou to discuss the current Guangdong steel market. They all agreed that Guangdong's prices are extremely unreasonable and have become the lowest in the country. This month, the leading steel mills will steadily push up to 2600 together, and the baton will rise as a result. In addition, as the construction of the northeast and northwest regions officially starts, it is expected to relay again.

It is comprehensively estimated that the current steel mills’ production rate is at a low level, the steel mills’ inventories and market inventories are insufficient, and the short-term resource shortage is difficult to alleviate. However, some conventional high-price areas are on the contrary at low prices. Forcing 3000 yuan/ton is a strong possibility.

PreviousNext

- Add:90 Huangshan Road, Yantai Development Zone

- Tel:0535-6370829

- Fax:0535-6396529

Follow mobile station

COPYRIGHT 2020 Yantai Fuxin Steel Co., Ltd. All rights reserved - 新闻中心